Pensions

Overview

Much of my work outside academia has been in the pension industry. I look at both defined benefit (DB) and defined contribution (DC) schemes, and the issues they face. I also consider issues in both the private and public sector. Continual changes to the financial and regulatory environment mean that new research is needed to tackle this ever-evolving sector.

Defined Benefit Strategy

Much of the focus of defined benefit pension schemes is on the size of their deficits – that is, the amount by which their liabilities exceed their assets. Whilst this is an issue, it is not necessarily the only way to think about pension scheme solvency. Much of my recent research is focussed on a different approach, namely the likelihood that pension scheme assets will outlast pension scheme liabilities. This means projecting both the assets and the liabilities many thousands of times, allowing for random variation. Such an approach is known as stochastic modelling. This way of looking at solvency has important implications for asset allocation, as it allows for any liquidity premium to be appropriately allowed for. It also means that the impact of longevity risk and the sponsor covenant – that is, the financial strength of the employer – can also be allowed for stochastically.

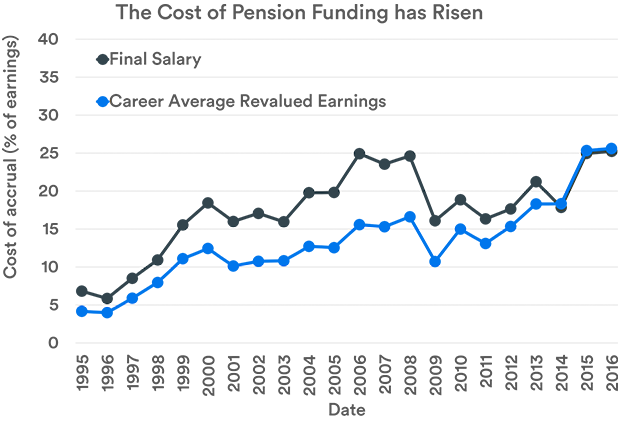

However, past service deficits are not the only issue for pension schemes. At least as important is the cost of future service, and this has risen substantially over the years. This is an area I have looked at several times, most recently here.

Here, look not just at how costs have changed, but also why. The benefits promised have changes, but so have life expectancy and – more importantly – interest rates. This is relevant not just for the ongoing affordability of defined benefit pension schemes, but also defined contribution arrangements.

Defined Contribution Strategy

The decline of defined benefit pension schemes has been matched to an extent by the rise in defined contribution provision. In the UK at least DC strategy used to be relatively straightforward, as most people bought an annuity at retirement. However, since the introduction of “Freedom and Choice” in 2015, people have had much more choice over how they can use their retirement funds.

One implication is that people’s defined contribution investment objectives need greater thought. Should someone be saving with a view to using cash drawdown? Or buying an annuity? Or just using their defined contribution savings as a temporary income before the State Pension is received? I have given several talks on this issue, and on how the defined contribution market can best be segmented.

For those wanting to save for drawdown, there are difficult questions to answer around investment and decumulation strategies. In order to answer these questions, it is important to define measures of both success and of risk. This is a key area of research for me at the moment.

State Pension Issues

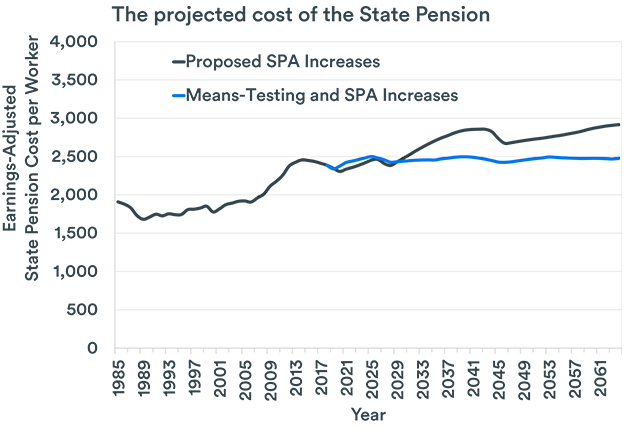

Whilst private sector pensions take up a significant proportion of my research time, I also have an interest in the State Pension. Most recently, this has been in relation to means testing and the State Pension Age – the report I wrote on this issue can be found here. This shows that the planned increases to the State Pension Age in the UK would still leave the State Pension unaffordable, with current workers paying an increasing proportion of their salaries. However, more aggressive increases to the State Pension Age would hit the least well off hardest, as they tend to have lower life expectancies than the wealthier. As such, means testing offers a way to control costs and to slow the rate of increase to the State Pension Age.